Bright Brief - Too Small to Fail

How the Next Crash Could be Good for Us, and Bad for [Them]

A few days ago, as is my want, I was pontificating on Truth Social, and I responded to a Truth from Major Patriot concerning WalMart’s laying off of a relatively small number of employees.

Big deal, right?

Wrong.

You see, it’s not the number of employees WalMart slashed last week, amidst continued tightening in the (totally not recessed) U.S. economy. It’s the departments those cuts came in. Namely, WalMart’s corporate offices.

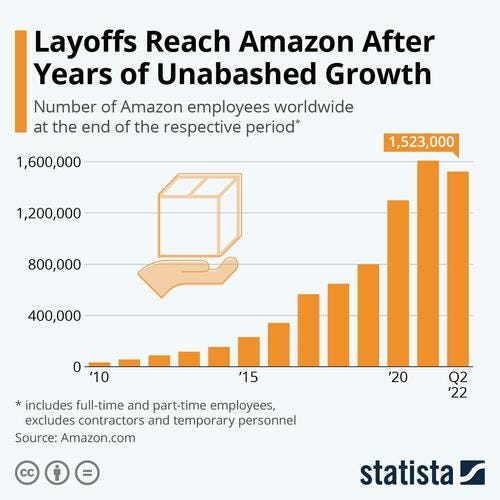

And WalMart wasn’t alone in their layoffs. In recent weeks, other major Fortune 500 companies have slashed staff, including Amazon, Netflix, Robinhood, Apple and others.

“This news comes as multiple companies are announcing layoffs and hiring freezes. Google parent Alphabet Inc. is instituting a hiring freeze. Apple is slowing its hiring this year. Coinbase is cutting 18% of it's staff. Microsoft has announced a hiring slowdown. Netflix has cut at least 500 employees recently, not including contractor cuts. Peloton is firing over 2800 workers so far this year. Online brokerage Robinhood terminated 9% of its workforce in April. Twitter cut 30% of its talent acquisition team this past month but declined to give a specific number of layoffs.”

Now, this isn’t meant to be an opportunity to gloat at the misfortune of fellow Americans. Sure, some of these employees likely shared in the Marxist ideals of the corporations they worked for. Most, however, took the best job that was available to them, and found themselves chained to said job so they could continue to provide for their families. This isn’t on them. Still, most in this movement would shed few tears to see most of those companies go belly-up.

But is it possible that they could? Are they too big to fail?

Well, let’s take a slightly deeper dive.

Again, many of these staff members have been concentrated at the upper rungs of companies. But what’s more pertinent to our discussion today is not even so much WHOM Amazon, Netflix, RobinHood and Apple are cutting, but WHY.

Even that might be obvious, right? Why even spend the time putting together a Brief about it? The economy is on shaky ground for myriad reasons. Cuts get made. When the economy bounces back, so too will jobs.

Yes and no.

On Truth, my response to the aforementioned cuts was as follows:

Seems a bit backwards, right? After all, isn’t it always small businesses that bear the brunt of economic recessions, especially those of the ‘planned’ variety?

Yes. Usually. In fact, the 2008 Bush-Obama economic crash was largely engineered by the knowing and later, the government-forgiven practice of major U.S. banks betting against their own customers and loan-holders. Of course, those loan-holders represented private citizens in the form of home loans, but they also represented a good deal of Mom & Pop businesses.

Sure, the WalMarts and CVS’s of the world saw some contraction, but ultimately, when Obama flew in with his golden parachute parade and bailed the banks out—not the Americans whose lives they stole, of course—he also bailed out a good portion of the Fortune 500, whose businesses are leveraged by said banks to an almost comical degree.

Are you beginning to see why something smells different about this one?

In my Truth above, I made reference to a hypothetical small business with $10,000 in monthly overhead. Now, assuming the business was viable—meaning they’re not barely skating by under normal economic conditions—it stands to reason they might have something of a nest egg set aside for an economic contraction.

The numbers might vary, but the underlying math does not. No matter how you slice it, IF no golden parachute parade is thrown on the backend of the coming economic crash—and I do, unfortunately, believe we’re in store for one—having 50% positive cashflow turn into 50% negative cashflow for a business with $10,000 in operating expenses is MUCH more survivable than having 1% positive cashflow turn into even 10% negative cashflow on a totally random, not at all specific operating revenue of $572,754,000,000 …

Now, if Mom and Pop can potentially survive a few months of a few thousand in red ledgers … how do you think the WalMarts of the world are going to survive—on the extreme low end—$47 Million per month in operating LOSSES … and if we take that 10% number, $477 Million in losses?

Imagine, if you will, a cruise ship and a row boat traveling in the same direction at the same speed. Not too fast. Not too slow. Now, imagine that a craggy, mist-laden island appears in front of each of them without warning, as if conjured from the ether.

Which do you think is going to have the chance to stop first? If they cannot stop, which vessel do you think is going to incur the most damage when it greets those rocky shallows?

Folks. [Their] economy is built almost entirely on leverage, just like their system of favors masquerading as politics, and I’m here to tell you that, if you think you’re leveraged with a mortgage … you need to take a closer look at the operating expenses of the biggest companies in the United States … and you need to ask yourself what happens if there’s no rip chord for them to pull on the way down.

[They] need stimulus. [They] need continued, artificial and accelerating growth. We do not. They are zombified corporations, subsisting on nothing but fiat debt and accumulation. They may be big, but this time, WE may be too small to fail.

As for WHY I personally don’t see such a parade being thrown this time? To put it as simply as I can, I believe Operation Warp Speed had less to do with vaccine development and more to do with actual (events) and potential (narrative) accelerationism. (More on this in a bigger feature to come.)

[They] planned for a Great Reset. And they’re going to get one. It just won’t be the one they had in mind.

Why? Well, that brings us back around to the point of it all. I don’t believe [they] are running the show. I do not believe [they] are in control. And I firmly believe we are being brought to the precipice … on many fronts at once.

As for WalMart, Amazon and other mega corporations—the modern oligarchy of the United States that leaders such as Vladimir Putin and Xi Jinping have dedicated their lives to burning out in their respective nations—I have a feeling that a certain (returning) President has his own plans for them when it comes to said precipice.

I think they’ll be given a push over the cliff the rest of us might be teetering on the edge of … but I don’t think he’ll be sending them over with a golden parachute. In fact, I don’t think he’ll be sending them over with any parachute at all.

And all this, without even touching on the fact that Trump issued executive orders permitting the seizure of assets of any persons (OR COMPANIES) involved in human rights abuses way back in 2017. But … probably just a coincidence.

Pick up your slings, then. And remember that Goliath fears you.

Until next time … stay Positive, stay Based and most importantly, stay Bright.

Join the Bright Army!

Subscribe for free to receive all future posts directly to your inbox.

If you value my perspective and the time I put into this publication, and would like to support my work more directly, consider choosing the paid tier for just $5 per month or $50 per year.

The best place to interact with me directly is by leaving a comment on one of my features. I read every one!

For those looking to reach me outside of Substack, I will be on Truth Social @BurningBright …

Encouraging article for a small business owner. My husband and I have been in auto repair for 40 years. We have tried to position ourselves to get through the crash we are sure is coming. Since the 2008 recession we have tried not to take on debt. We always thought big business had it easier than we did. Our shop is paid off, we are fortunate. Just going to keep working and waiting on better days.

This ABSOLUTELY "Brightened" my day!! I have enjoyed your writings and reading of your work by Patrick Gunnels--another huge fan of yours!!