Weapons of the Future I - The Bridge

Weapons OF the Future ... TO the Future

This feature represents the first in what I call the ‘Weapons of the Future’ series, and continues with ‘The Switch’ and ‘Amerigeddon.’

To paraphrase and repurpose a famous financial quote from one of the stalwarts of the falsity inherent in the System of Systems, “it’s the economy, stupid.”

And the economy is broken.

How?

Well, not that this community needs me to convince them, but a post I made back in August still holds water today, and should set us up nicely for what I hope will kickstart conversations in a community sometimes more calcified in its viewpoints than its heterodox and divergent origins might suggest.

Thus, from August 25, 2023:

“The Economy Is Broken ... But Not in the Way [They] Intended:

Tech stocks, including NVIDIA, have been surging on news that revenues are up. This trend line flies in the face of the Narratives most of us have been inundated with for months, that the US economy is on the verge of collapse.

The thing is, both can be true, and that's why I think the FED, Jerome Powell and the Central Banking apparatus in general are caught between a rock and a hard place that Donald Trump's COVID money-printing spree in 2020 have set up.

While I ultimately believe this is a good thing in an escalation, acceleration and Game Theory reading of the economic situation, and the rebalancing multi-polar world order, it's absolutely going to make for a rocky transition period.

Essentially, Powell is looking for any possible indicator that will allow him to continue to raise rates, and tech stocks and revenues surging is going to be a major one. This indicates that the current interest rates (records going back to the Reagan era,) are not enough.

Again, retail sales and home sales are collapsing, but the tech sphere is surging in places. The economy is effectively broken, we're likely going to be staring at double digit mortgage rates, and it still isn't going to stop inflation.

I think it's just all part of setting up the Narrative that a FED pivot to slashing rates is impossible, because too much fiat was printed (by Trump and Biden,) since 2020.

What I think is happening here is that the dollar is already dead; we're just watching its zombified corpse effect a bizarre animation ritual until the American people realize the ‘stock market’ bears zero resemblance to and is completely decoupled from the actual economy.

If the FED does pivot, and slashes rates, we actually start to look at Venezuela/Weimar Republic situations, and that will probably be a signal that we're in the endgame.

Oh ... and did I mention that BRICS just made its most seismic announcement since its inception with the pending induction of Saudi Arabia and the Gulf States ... the last keystone holding up the ghostly visage of the Petrodollar's might?

The Central Bankers aren't new to 'breaking' the economy; they're just used to breaking it in such a way that it allows them to scoop up all of OUR assets in a planned crash while keeping the fiat currency going in a weaker, increasingly devalued state. This time, they can't crash the economy without ALSO crashing the dollar, which is the source of their power projection in the first place, and their CBDC idea isn't going to be adopted in foreign trade, rendering the newest Great Reset system dead on arrival.

Sometimes, Bad News is Good News in the Mind War.

Sometimes, you can't tell the people the truth. You have to show them.

Trump told us this would happen. As usual, he was right, because we're watching a plan unfold.

It's up to you to decide whose plan that is.”

And while we could and have played ‘Whose Plan is it, Anyway?’ for much of the last seven years, today, I want to focus on what has to be a key aspect of any plan to the future, and that is to understand and reconcile the foundational issues that mar our past and continue to define our present, and outside of governmental systems of control we continue to track, cultural subversion we’ve observed and kinetic corruption in other lands the Prussian proxies on the game board continue to foment, the key to the System of Systems has ever and always been the control over the key system of control in the first place, that being valuation, exchange … money.

Still, what used to be a feature of [their] Hegelian economic deathloop has been warped in my view, largely and ironically through some of the tangential and invisible effects of my personal spin on Operation Warp Speed, which I believe had about as much to do with vaccine development as Joe Biden does with foreign policy.

In both ‘The Spider-Man 2 Effect’ and ‘The Good Reset,’ I laid out the foundational view that patriots—with Trump at the helm—are largely responsible for kicking off the most accelerated fiat money-printing scheme in American history during the advent of the Covid era, and rather than viewing that as a bad thing, I see it as a temporal strike against the key source of power projection within the enemy matrix, an acceleration that effectively lit a fuse on the false fiat in its current form and set up the incoming Biden Admin for a series of dominoes it had no choice but to chase and track, but whose spiral couldn’t be stopped, and so had to be helped along.

The only problem for [them] is that their usual, pre-seeded solutions don’t seem to be in the offing these days, because this wasn’t their plan, as it wasn’t implemented on their timeline.

By accelerating the enemy’s own rug-pull, I believe patriots effectively rug-pulled the Establishment, and did so in full view of the global populace, even if most didn’t see it at the time.

And while the ‘Good’ Reset theory encompasses the pattern of acceleration, its ensuing escalation and their resulting exposures in all pillars of the System of Systems, from the Cultural and Political to the Clandestine and Narrative, the Financial has ever been the base layer holding the whole corrupt, diseased temple up in the first place, and thus, it could be the most important to not just destabilize in a bid for decentralization and recaptured sovereignty, but to redefine and rebuild so that the dissolution of [their] system isn’t simply replaced by one of temporary, halting virtue, but rather perfect permanence.

It's also just about the only scenario outside of a major ‘Scare Event’ that has the ability to seize the full, rapt attention of the entirety of the Collective Mind simultaneously … all the better to change it with.

As I explored at length in my most recent feature, there are ‘Shatterpoints’ emerging within the Collective Mind, and while the enemy has historically used these points of weaponized psychological tension in order to poke and prod frightened minds into their Hegelian, systemic grooves, that trendline has reversed, with both Micro and Macro shatterpoints far more likely to lead awakening minds toward a decentralization pattern under the noses of the centralizers.

And for the first time in a long time—though not for long, in my estimation—the Mind-Mover on the game board that is more clearly threatening the gossamer curtain masquerading as a set paradigm that is the False Reality (h/t Chris Paul) than even Donald Trump is Elon Musk, an enigmatic billionaire who first rose to prominence through the rising, ‘new tech’ zeitgeist of disaffected modern liberalism.

That’s right, before Musk was favored by MAGA and the America First movement, and before he was a paragon among libertarians, he was favored by Anons, who never had a political leaning before the advent of Trumpism, when adherents to the Chans and the memetic gray web—the real internet, for what it’s worth—infused the Republican movement with its most lively energy in decades almost purely through the motivation and implementation of meme magic, which is far more real than most have considered.

And yet, what started as a somewhat magical, cosmic ‘joke,’ and an opportunity to tear down the Establishment through Trump quickly morphed for many of us into the first glimpse of earnest hope that the System could be torn down without destroying society, if only that society could be reforged and reformed—prodded and prompted by forces of good, this time, into the recognition of its own sovereign origins, and perhaps its destiny.

Musk rode a similar wave of disillusionment mixed with wonder into prominence, but the fact that his rise was not only NOT political, but almost anti-political ingratiated him to a younger, more tech-savvy demographic, while his sometimes-outlandish promises of technological innovation on a consumer level recalled the original Tesla, aligning him with some of the philosophical leanings of communist lemmings who fell for the Bernie Bro movement hook, line and sinker.

In fact, it was this Bernie contingent—this betrayed and wounded voting bloc—that Musk was able to sweep up in his rising sociopolitical wake when Trump’s brash bravado proved too strong and too effective for those too far left—too divergent, even—on the ideological spectrum to endorse. His move onto center stage in the realm of politics is not just serendipitous, but, given his position as the largest Department of Defense contractor under President Trump, his seizing (read: supposed free market purchase,) of the biggest Narrative Weapon in a war built on the dissemination (by us,) and corruption [by them] of information itself, and his ability to conjure memetic moments with the frequency and virility—if not the force of will—of Trump comes at a time in the Info War, the Mind War … the Strange War that can only be called auspicious.

Musk’s deployments verge less political than Trump’s for obvious reasons, but he’s able to attack the Financial, Economic and even—through his exposures of intel agency corruption in the Twitter Files—the Clandestine pillars of the System of Systems from a different position within the Collective Mind than the MAGA King. This makes him a target for this system and its players, but it also makes him a marker in the Mind War, and one that is doing the moving far more often than its being moved.

Musk, like Trump, acts rather than being acted upon, and has the ability to both threaten existing paradigms while planting the seeds for new ones to sprout in their wake.

Originally, when Musk burst onto the mass cultural scene with the surging Tesla company and its revolutionary electrification tech, I thought the game had been given away by the name of the company itself. I saw ‘Tesla’ as a bit of Hegelian mockery … the Cabal using its latest tech cultist cypher to seize mass psychological and memory-based coding of suppressed genius and stolen progress in order to reskin and resell it to the useless eaters—to us lowly plebs and consumers—under the guise of futurism.

And while my current Cognitive Cypher still holds that the naming of the Tesla company was indeed mockery, I’ve gone through a total inversion, and believe those who are currently screaming the loudest to decry Musk and all his ‘Trumpian’ sins are the very heirs of that System of Systems his tech, his economic position and even his cultural sway have served to undercut and head off time after time.

That’s right, rather than piling on to the EV craze and lumping Tesla in with the bunch as I used to do, I’ve gone through a reframing process in light of his Actual connections to the patriot movement—and to Trump in particular—as well as the always-illuminating whip and lash of the enemy’s words to re-contextualize Tesla as a massive asymmetric warfare deployment itself, a vehicle (no pun intended) for both disclosure of the technological variety in an ‘organic-seeming’ rollout, AND a weapon of financial acceleration targeting the more controlled, systematized and limiting ‘Green Beast’ that was the enemy’s preferred technological and economic transition, and that is now dying on the vine, largely due to Musk’s superior offerings and recent price wars targeting everything from Big Tech and Big Auto to Big Energy.

In effect, while Trump’s actions (both publicly-known and guessed at,) accelerated the enemy into the mass exposure of their political and cultural aims, and perhaps pulled the pin on their economic grenade, Musk’s have followed a similar pattern targeting the very systems in which society engages with each other, from transportation in a literal, corporeal reality to that of communication itself … ideas, which are the most powerful deployments in the Mind War.

This has resulted in the ‘Crisis Cascade’ I’ve been writing about for the better part of two years, and that will become unmistakable to even the Normie Layers of the Collective Mind as the System of Systems is laid bare ahead of its controlled demolition in 2024 and beyond.

This Crisis Cascade is going to FEEL and even LOOK like it’s targeting our side—the side of truth, justice and yes, the American Way—but the resultant whiplash will quickly and (at least metaphorically,) violently shift the tide, as the System of Systems cannot bear the weight of the mass turn that’s now as inevitable as the movement of the cosmos.

And none of this is even touching upon the true significance of that ‘Tesla’ name, and all its connections to the Orange Man himself, which many in this community of truth-seekers are no doubt aware of.

So, then, what have Musk’s Net Effects been on the Info War—more so, on the Collective Mind that is both the battlefield and the grand prize by any and all sides on the Game Theory Game Board?

In the end, as I argued beginning one year ago in these digital pages, I believe Musk and Trump are effecting a Mass Psychological Pincer, both combating the Establishment’s System of Systems from opposite angles while scooping up awakening minds the other misses, ultimately pushing them in the mutual direction of both direct-path reasoning and sovereignty over everything from their minds to the lives those minds drive, which cannot but improve the overall outlook of the nation we hope to both save and build anew.

Musk, like Trump, makes up a Vanguard unto himself in the war against the Deep State’s Narrative arm, its Financial Arm and much more, as these characters are being used to forward both exposure and disclosure, whether or not these technologies, philosophies and patriots’ plans originated with them or collectives behind them whose origins we can only guess at, and that are most assuredly aligned with those behind the Q Op.

Under the War of Stories framing, the writers take a back seat to the characters on the page, as they are who the reader, the viewer—the engaged and engaging mind—seizes onto, remembers and ultimately, accepts as a vehicle for both subconscious and conscious change.

That is why I ultimately view Tesla itself—as well as its founder and its lead pilot—as less an organic operation of innovation and technological reform, and more a vehicle for disclosure, and likely the first of many that will emerge in the new age of Trumpism, and the American Restoration and Renaissance to follow. This disclosure is helping to bridge the past through the present and to the future, providing firm footing for us to participate in the redefining of all human systems, and it’s being done through asymmetric warfare from asymmetric leaders.

As such, it’s best you get comfortable thinking asymmetrically, and applying your full cognition to the act of understanding before reacting, as friend and peer Just Human preaches with regularity.

And if literal vehicles are ubiquitous to the American identity and remain as important as ever to the functioning of American life, business and economics, and if Narrative vehicles are what we track most often at Burning Bright, what other sort of vehicle could have the power to help move the decentralized collective that humanity once was and could be again into that bright future so reminiscent of a half-remembered, mythic and even Biblical past?

Perhaps the weapon Musk has teased longest and most enigmatically, in keeping with his (crafted?) persona is one that finds itself at the center of frequent—and oddly vitriolic—argument in the Truth Community, as a voting bloc that prides itself on recognition of the Real can’t help but to lump the digital and even theoretical into the realm of the unReal.

Bitcoin and all its implications—and certainly NOT many of its false, crypto cousin permutations—takes up a good deal of my cognition in recent months; after all, the origins of ‘X.com,’ the precursor to Musk’s current ride was a platform for processing peer-to-peer payments across an internet only just beginning to find its way into the homes of a majority of Americans. X.com transformed into Paypal, which Musk abandoned in the staccato lily pad pattern of movement and innovation that has come to define his mind and his business moves, and I believe there is both Narrative and technological purpose to this seeming shell game.

Then again, I’m one of those kooks who finds it hard to believe Musk is anything other than an ‘asset’ on our side of the game board, much like Trump himself, and that both likely have been members of what the Q Op dubbed a ‘Civilian-Military Alliance’ for far longer than most are able or willing to consider, and certainly for longer than any of us were de facto deputized into through our sheer force of will or weaponized autism.

Either way, the revival of the ‘X’ branding and online destination also seems rather auspicious to me, along with Musk’s alignments with blockchain technology—the underlying backbone to Bitcoin as a system of valuation and record-keeping—and one that could change the future of everything from historical record to election reform.

But its greatest implication as a technology is also its first, and that is in the formation of Bitcoin itself, a system of valuation based on the very concept of scarcity, and the only human invention thus far to render a system of accounting so perfectly finite—and most importantly, whose future quantity and energy flow pattern is KNOWN, unlike corporeal stand-ins, however shiny—that it could help bridge us into the infinite.

Trust.

Trust is what money is all about.

In fact, money was formed on the basis of defining and accounting for trust in the first place, whether through gold and silver or the diluted coinage and eventually the paper notes that came to ‘represent’ it. And yet, even the most brilliant of precious metals and gems in the Earth’s crust can be hoarded and hidden, their quantities suppressed or inflated based on discoveries, suppressions and timed disclosures. So, while I believe they have a part to play on the road to our endgame, I don’t think they represent the endgame itself.

What is the biggest weapon of the System of Systems, then?

Energy.

And not in the form of the stuff that powers everything from our toasters to whatever’s sitting in our driveways or, perhaps eventually, hovering over our rooves, but rather the energy of life.

The energy of reality. Time. Power. Rather, the taking of each from us.

Ultimately, the best-case scenario for technological progress isn’t to make things ‘cooler’ or even easier for the mass of humanity scraping by in the Hegelian system they’ve saddled us with and baptized us into, it’s to give us our power back, which is to say, our time, which is to say, our freedom.

And freedom and time combined form mighty fertile ground for the fulfillment of the true purpose of humans and humanity … that being creation, in keeping with God’s image and designs.

So, then, whether or not you personally think Bitcoin is a big deal, the powers that would be think it is, as the very concept of scarcity is anathema to vampires and leeches, and foundational to creation and permanence.

Is it possible, through this lens, to both defang the enemy’s System of Systems while arming the sovereign one we hope to erect in its place?

And if so, why is there so much argument against the concept of Bitcoin and blockchain technology … and why is Matt Damon trying to get my mom to sign up for a Crypto.com account?

Hell, even Donald Trump’s rare communications on Bitcoin have been confusing, as it’s true that he’s called it into question, and in the next breath, praised the strength of the US dollar. I see these Trump statements as indicative of the pattern of reflection and MAGA mirroring Chris Paul has noted, where Trump displays an uncanny ability to draw attention to the failings of the fiat system and its current weakness while acknowledging the ability for Bitcoin to threaten it.

(There’s a reason I have an ongoing series called, ‘The Master,’ in which I attempt to explore and examine Trump’s uncanny ability in the realm of Narrative Warfare.)

Trump is still in the stage of calling attention to what the enemy has stolen from us; he is still tearing down, while the time for building anew has yet to begin, even if his toe-dipping into the realm of the NFT represented a memetic and encouraging tell to many that his mind is perhaps more movable (and will move others,) into the direction of blockchain in many forms in the future, despite the legion of fraudsters and pump-and-dumpers that particular industry is made up of.

And therein lies the rub; the problem with Bitcoin isn’t a problem with Bitcoin at all.

It’s a problem with those who would seek to obscure its origins, obfuscate its use cases and dilute its singular uniqueness amidst a sea of imitators controlled by CEOs and ETFs, and, admittedly, it’s sometimes a problem with the communications approach of those who advocate for its adoption on a mass scale, believing earnestly, if zealously that measuring wealth in scarcity—in permanence itself—is the only way to truly defect from a system designed to keep humanity from even considering such a thing, never mind attempting it.

There is a method to their perceived madness, and if one swims in those memetic, chaotic and yet, oddly serene waters long enough, appeals to Musashi might not be far from the mind’s eye and the lip’s uttering, for when you know the way broadly, you may come to see it in all things, even those you once dismissed, or still dismiss now.

To borrow another term from Chris Paul, these natural and even accelerating arguments should not be seen as a bad thing, but rather as a natural and necessary ‘sifting’ process that will undoubtedly and inevitably leave all parties closer to the truth than they were before it.

From where I’m standing, Bitcoin maximalists are far closer to the truth—if not right over the target—than those who dismiss them out of hand, even if I think their recalcitrance to engage with the Political, Cultural and Narrative pillars of the Info War on the grounds that said approach is akin to treating the symptoms rather than the underlying disease is sometimes shortsighted. I also believe their dismissal of those who do engage in these theaters misses the alternative point—that being that saving the world doesn’t really mean much in the end if the world that’s saved is a corrupted shadow of its former self—and betrays an assumption that those walking other paths more regularly can’t jump from one rail to the next.

In my own personal War of Stories refrain, I believe in observing the Micros on the game board in order to both guess at and even help to direct the Macros. Under this framing, seeming fixation on the Micro—on the symptoms of a sick society—can be re-contextualized as symbolic of the Macro and the whole, and encourages observing minds to leave Actuals to the side in favor of the tracking of Narratives, which isn’t so much an irregular form of power projection, but more so, in my view, the ULTIMATE form of it.

After all, if Bitcoin or any other transcendent and transformational technologies and sovereign weapons are to be adopted on a mass scale, thus lending them both the public mandate and its mass psycho-actual power projection they truly require, they will be done so through the successful waging—and eventual winning—of the Narrative … of the stories.

As for the WHY of the Narrative, it’s what I’ve spent most of my words exploring at Burning Bright. And the WHY of the War of Stories is all about public mandate, which is to say … choice, and the freedom to be able to exercise it on a level playing field, something the powers that would be have robbed from us for generations. In other words, the STORY of the thing is more real than the thing itself, which is why I have always appealed to Plato and his forms and ideals more readily than Aristotle’s focus on the corporeal.

In Bitcoin, I see a marriage of both, with an Actual systemic destabilization weapon being merged with such limitless concepts as perfect permanence and, at least in a manner of speaking, the very zero-point energy the original Tesla spoke of, albeit in a more foundational form.

Bitcoin could be described as the concept of acceleration itself, as it has the ability to accelerate the very melt-up we’re witnessing in global currencies today simply by existing, while also pouring and setting a foundation of slower (and thus, more permanent, though imperfect) exchange systems atop it as we work to transition both Actually and Psychologically from a system built on the unreal to one built of the real.

The reason I tend to discuss Game Theory with such regularity around these parts, and the core tenets of Finite and Infinite Games is less temporal—though it IS that as well—and more energy-based. As I have argued many times, the reason the side of truth always wins in the end, so long as it stays in the game is because it doesn’t need to expend the energy required to keep it covered up, which is why the simple utterance and sharing of truth threatens the False Reality.

Truth is a self-perpetuating engine, self-defining as its opposite is self-defeating.

Adherents to the Bitcoin maximalist philosophy would hold that blockchain’s underlying and core ‘proof-of-work’ concept defines, crystalizes and codifies time itself, meaning it essentially freezes energy into a state of confirmed permanence and allows value to be placed upon it by a market that can only be free if its foundation is immovable.

And at least in this respect, the math is as immovable as Bitcoin itself; despite archaic views to the contrary, it is already quite literally the hardest asset in the world relative to everything else, and yes, that includes gold … and that’s coming from a writer in yours truly who holds the shiny rocks, myself, believing they will represent a slower form of the semi-hard value melt the economic system is going through today.

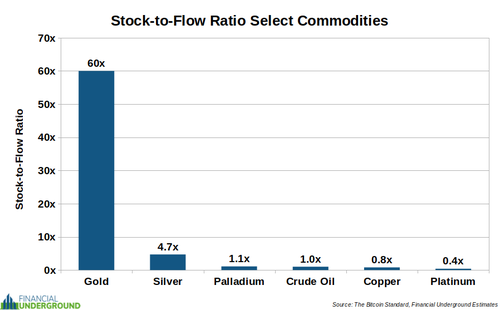

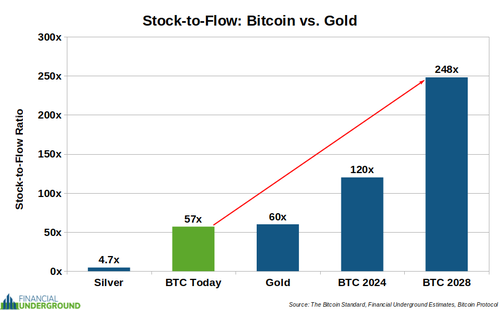

Perhaps the best way I’ve personally seen to measure this perceived ‘hardness’ is in the Stock-to-Flow ratio of a commodity, which is essentially a measure of the readily-available supply relative to its production (or discovery) level. The higher the stock-to-flow ratio, the more resistant a given commodity is to sudden market dilution and devaluation.

As we can see through the research of Nick Giambruno at InternationalMan.com, gold does indeed perform admirably according to this metric relative to other ‘assets.’

And yet … even it pales in comparison to Bitcoin … a trend that will only accelerate as the fixed supply of the math itself continues to churn and burn into glorious (and gloriously-shrinking) permanence.

And yet, I know from experience that some minds aren’t going to be moved by charts and numbers.

So let’s talk about math … not in terms of Actuals, but in terms of Potentials. Of philosophies.

And, despite the Prussian public school system having done its damndest (and, inarguably, its job) in convincing generations of American youth that mathematics is less an expression of God’s sheet music of creation and more a Hegelian torture chamber of wheel-spinning and complexity for its own sake, math is a big deal because, put simply, it works more than anything else in reality, as it IS reality.

Math is perfect. Math is real. Math IS.

This expression of fundamental and foundational reality is sense-making made observable, and logic incarnate. It is, in other words, magic—an infinite power capable of rendering something expressible and finite.

And if I were to describe what Bitcoin is—or rather, could be—it’s that: an infinitely-powerful potential built out of an expression of the Finite. A perfect paradox, not unlike Anons and the Truth Community itself, which I have long described as a decentralized collective.

If there’s anything the False Reality [they] have erected has been missing, it’s not just scarcity, but reality. Solidity. Logic.

This is both the starting point AND the ending point on which to peg valuation, which is to say, meaning that can be transferred in the form of trust from one person to another, one society to another … even one time to another. That is the true meaning, and the true decentralized power of ‘peer-to-peer,’ once you get past the sometimes-overwhelming technicalities of it all.

Bitcoin’s technology, its ledger and its core functionality—its literal past, present and yes, its map to future supply—is literally etched into its public, open source code, making it not just a technology that’s difficult to control by corporations, governments and the bankers that hold both under sway, but literally impossible.

And so, while the brash bravura of the Bitcoin maximalists (maxi’s) can be a turnoff to some, my appeal today is not to adopt their underlying philosophies, but rather to examine the questions that brought them there in the first place, and to let them take you to whatever answers they will.

Engaging with the concept of decentralization is foundational to being an Anon, a Truther and eventually, a true Sovereign … and if you come to believe that decentralized energy already exists in the form of blockchain ledgers and harnessed math itself—incorporeal time made corporeal—all the better.

So, even if Bitcoin itself isn’t your choice for a bridge to the future of a sovereign, free monetary power projection system, understanding why some believe it is could represent a bridge to understanding what money could be, and perhaps should be on the timeline of societal evolution.

If blockchain technology can and is being applied to everything from voting systems to vast data transfers, identity codifying and all persuasions of Micro and Macro security systems, why wouldn’t we consider its vast, compelling and encouraging applications to the most ubiquitous form of power projection in the modern world? Why not take the role of decentralization more seriously—MOST seriously—when applying it to what the centralists themselves—the bankers—have used to lord over us?

Instead of trying to take our money back from them, why not redefine it so that each and every sovereign mind controls its own wealth and codifies its own freedom, concepts that are baked into both the genesis of the American Revolution and the Constitution it birthed, and the Republic that rose up on its tenets?

After all, just as threats to sovereignty ALWAYS begin with money, either by corrupting it, diluting it or controlling it, a reversal could and is working wonders, if only you cultivate the eyes to see it happening all around you, very slowly … and then all at once.

The System of Systems the Deep State built and defends to this day doesn’t just wield a corrupted form of the Hegelian Dialectic as its change engine … it IS the dialectic. It’s a story they’ve told us and coerced us into participating in in order to both define and codify a reality that’s as illusory as the power it holds over us.

The System of Systems and its Hegelian Hydra has cast a dread spell over the populace that hinges on making the unReal Real. It’s a doom loop not about terror through damage, but rather through trauma, which is more about paralysis—about standing still—than abject defeat or annihilation. We must survive in order for the Deep State to profit off of us, and we must exist in order to give the meaningless meaning.

Gold, silver and other commodities represent both valuation layers and tradable assets, to me, but I am starting to see them as just that—layers piled atop something more foundational, as even those can and have been manipulated throughout human history. If we imagine valuation itself as a layered cake, then I see gold and silver as the ice cream filling—cold, hard and seemingly permanent, with the falsity of the fiat frosting melting fast atop it. This melt is already in process, and as the whipping drips and soon cascades, the shine of the gold and silver interior begins to attract attention in the Collective Mind, further exposing and accelerating the melt of the false fiat layer above.

That said, I believe that even that hard, cold gold and silver will begin to warp and melt, as, while ‘real’ in a way the fiat frosting is not, they are still bound to the same supply-demand production system sway as those from antiquity the powers that would be and have been have successfully corrupted, hoarded and ultimately diluted long before they had digital alchemy at their disposal to do the same in more rapid—and devastating—order.

In my estimation, commodities could and will eventually be train carts moving atop foundational rails that, once set in another century, when the last Bitcoin is pulled from the ether of equation, could provide a perfect track atop which future exchange takes place. The final failsafe.

In the end, the only way to stop the ‘melt’ of the whole system of valuation is to freeze the base layer into a state of permanence, and the only way I see to stop the theft of our time is to codify time itself, and you can ONLY do that through the harnessing and finite defining of math.

As I said in my last feature, proxies may wield the power of collective mandate, but we ARE the power, and it’s time we started acting like it in more theaters than JUST the political, cultural and narrative. It’s time we took the fight to the enemy’s system by defecting from it in the most foundational way we can.

With Systems of the unReal being rendered more Real by the year, with the rise of BRICS, themes of production, from goods to energy dominating the zeitgeist and largely ubiquitous with the America First mindset, from trade wars to tariffs and the emergence of the multi-polar world order, all are seeding and running parallel tracks of ‘Sovereignty as the Solution.’

Ultimately, energy runs the world, and the ability for systems to centralize its control and distribution—and therefore, its valuation—will ever and always lock us into a loop of temporary control, which changes from one party to the next, from altruistic to demonic, but never coming from the people and of the people.

In ‘Shatterpoint’, I appealed to the direct path WITH a direct path. We have to apply the same thing to how we define our very time, and our very energy, and our relationship to the society we’ve been born into but pretend to have a say in, and affect.

How, then, do we truly decentralize? How do we harness the ultimate energy, which doesn’t power our cars, but defines every layer piled atop the base?

We weaponize math itself. We weaponize the Finite, therefore becoming Infinite Players on a Game Board they no longer control.

I see the political story as a layered narrative that's a piece of a much larger whole, that is eventually leading people into a version of the defected (read: ‘fuggem’ for the maxi’s) mindset that is all about rediscovering human sovereignty.

Something brought each of you along the path you ended up on. You didn't end up there yourself and we don’t know if an angel beamed it into your head. A story brought you to the Info War and the Great Awakening, just as a story brought the maxi’s to Bitcoin.

That's what ALL of this is, politically and socially. It's an exposure campaign of the problems and a melt up or down to the solutions inherent in the attempt to solve them in the first place. It's a Reverse Hegelian Dialectic. A ‘Good’ Reset.

Extending the timeline of the transition saves more, not fewer.

The reward for those like you who could be ahead of the curve is self-actualizing.

The War is a Story, and the Story is a Bridge.

I would not personally see Bitcoin and its underlying reality and philosophies (which are inextricable, as the argument can be made that the technology is in and of itself a philosophy incarnate) as the entirety of ‘The Plan,’ but rather as a potential foundation—a means of both accelerating the decay of [their] energy systems they have trapped us in and ruled us with—supported by theories of Trump’s Operation Warp Speed I’ve advanced in the past—while consolidating and collapsing divergent systems of exchangeable decay that are built out from a base layer built on nothing more than something itself—math, the ultimate expression of sense, and perhaps, of reality.

The base layer of formerly incorporeal reality made corporeal. The unReal made Real.

Human beings do not have the power to make something out of nothing; we can hear the wild notes of creation and can spin them into music, but we didn’t create the sounds.

Similarly, perhaps we’re closer than ever to realizing on a mass scale that there is no such thing as ‘nothing’ in the first place, and that math, time and the expression of energy itself—meaning the measure of ‘thing’—represents the source code of God’s creation, expressed in terms that bind the Hegelian Infinite Decay into a Perfect Finite that might stretch us into the infinite of permanence.

The powers that have been and would be again have taken much from us. They have taken lives through Proxy Wars, nations through Proxy Leaders and the conflicts they spin up on marionette strings, and, if you’ve trolled the darkest depths of the Info War, and learned of the dark sins that bind their empire of blood together, you’ll know they’ve even taken our children.

But it’s our energy itself that they have stripped from us and loaned back to us on a drip and trickle, looping our strength into a self-devouring Ouroboros that makes each of us and all of us tangentially responsible for our own waste and ruination.

In order to take the rest back, we first have to take back our energy, which is our time, which is our selves.

What is the best argument (to me) for Bitcoin, then?

Sovereignty incarnate, as even the very concept of wealth preservation according to blockchain holds that the memorizing of a ‘Seed Phrase’ places the literal key to your wealth in your very mind, which truly and emphatically breaks all systemic control vectors and codifies the individual with complete responsibility over their own lives.

Which is the whole point, isn’t it?

My purpose here isn’t an appeal to buy Bitcoin, or even a conclusive argument that it IS the answer to all of our problems. I think it COULD be the energy of the future, and a key component, if not the foundation of both our new economic system, underlying layers and all, and also of the ultimate rug-pull on the enemy system, even if gold and silver bridge the gap from here to there.

My appeal is for Anons to embrace their heterodox thinking that brought you to question your reality in the first place, and seek your own answers, but to do so by first understanding or attempting to understand a technology that the powers that would be have attempted to subvert through a mountain of CEO-backed, celeb-endorsed Crypto rug-pull bullshit.

You may not think Bitcoin is the answer to doing so, but if all this exercise manages to do is prompt you to think about how we define the foundation of exchange, which makes up the root of peer-to-peer relationships, which make up the cascading layers of any formed society, you might begin to see everything in terms of decentralization. Freedom defined.

In the end, I don’t know if BTC is the ‘answer’ … but it might be the right question.

As my friends Chris Paul and Patrick Gunnels often argue, the first step to losing an argument is to adopt enemy framing of that argument in the first place, which is to say nothing about the underlying merits of one side or the other on Actual grounds. As Just Human implores, understanding is greater than reacting, and as the paradigm-shifting research of Jon Herold and the Devolution Series demonstrate, sometimes the puzzle pieces are in front of us the whole time, if only we have the awareness to pluck them from the world, the animus to mix them with our cognitive might, and the discipline to put them together in the right order.

By endorsing constitutional and legal processes that would remove a sitting president we don't like, we're tacitly endorsing and even legally codifying the premise that he IS the sitting president.

Rejecting enemy framing is the first step to freeing oneself from the need to backtrack along logical grounds, as it prevents the enemy from trapping you into a circular argument … into the Ouroboros.

Don't try to win arguments, then; render them moot.

Don't try to 'beat' the Deep State; render them powerless.

Turn the serpent back on its own tail.

Does the Biden Admin matter, then? No. And … Absolutely, as it’s the biggest mass Exposure Campaign ever launched on the American people, which will, if we’re right, inevitably lead people TO the end path.

As for the end path itself, I suspect it is as multifaceted as it is singular, which is to say, I believe it all ends with where it began, and that is with the recognition, remembrance and full embrace of sovereignty.

Choice.

Freedom.

War is all about Power Projection, and Fifth-Generation War is all about irregular power projection. If we ARE the power, then it’s time to project, a process that is already well underway due to the mass defection from the System of Systems in all theaters of the Info War, the Mind War and the Soul War at once.

At the start of this piece, I questioned whether or not the rug-pullers had finally been themselves rug’d.

Re-contextualized through the lens of Shatterpoints in each theater of the Info War, from the Political and Clandestine to the Cultural and Narrative, and we might ask, what is the ultimate Shatterpoint?

He who controls the money controls the nation, but if each man is to be a nation unto himself in the decentralized, cooperative world many of us envision, it’s time to challenge the decaying and dwindling finite masquerading as infinite, and harness the truth of reduction, distillation and bedrock real.

The falsely financial holds the whole diseased, corrupt temple up, and so, its collapse could bring the whole thing down. And yet, no matter what the ultimate plan is, I don’t think the final rug-pull will leave us spinning in the void.

After all, a famous book claims that, in the end, God sent frogs to destroy [them.]

So, while the tracks through the infinite stars may have been laid while you were sleeping, and while they may not be easy to see in the blinding bright the kaleidoscopic chaos of the Info War has become, if you devote your mind to it, you might begin to trace the various rails, and hop on for what figures to be quite a ride to the future, and of it.

Until next time, stay Positive, stay Based and most importantly … Stay Bright.

If you enjoyed this feature, consider checking out the follow-up, ‘The Switch.’

(Author’s Note: NOTHING in this post should be taken as financial advice, only a philosophical musing on the nature of money and energy itself. I highly recommend the writing and commentary of my friends G-Money and Patriots in Progress if you’re looking to follow a fascinating cognitive pathway you otherwise might have avoided to this point in your travels. Wherever it takes you, enjoy the ride.)

Burning Bright’s goal is to provide a valuable resource for Truth, Discernment and Logic-Based Positivity. To receive new posts and support my work, consider becoming a Free or Paid Subscriber.

Want to submit a one-time donation? You can do so by buying me a coffee!

Paid supporters allow me to devote the time and research necessary to make this publication unique. All members of the growing Bright Army are appreciated.

I see the argument of math and energy being truth. BTC then appears to be a solution to the everlasting power/control dilemma of individual sovereignty in a socially necessary structure.

My problem with BTC being THE solution is that it is entirely dependent, initially on computational power, but ultimately wholly reliant upon the electrical grid that in scale is controlled by the same powers that be and CBs. Nuclear war would largely eliminate those structures, and a Solar Flare would end them for many generations.

The solution to that could be the legendary Nicola Tesla free, natural energy approach. We do not know how that could work in reality, though I've seen drawings of towers and the like. Yet even those are reliant upon the current manufacturing and financial structures that would be in vehement opposition to their replacement.

'Catch 22' it would seem.

I'm elderly and won't likely survive the transition to any other societal form, barring the Rapture, so my dog in this hunt is of limited relevance. But my genuine concern for the future of humanity and individually sovereign freedom is absolute.

BB, you covered a lot of ground in this article. On the Musk side, we are in complete agreement. I have gone back and forth on whether or not he was an asset of the DS or a 'white hat' and he has finally tipped his hand to the good guys. On the financial side, I would say I largely agree with you in that Block Chain is the future. Bitcoin is a block chain creation and has the sexiness of valuation explosion vs 'traditional money' aka Gold, Silver. This gives bitcoin, a seemingly new type of money, a fair amount of appeal. The 'math' you talk about, that comes from block chain structure, has an absoluteness to it that attracts those of us who see the doom of fiat. What I would argue though, is that Gold and particularly Silver, have been suppressed by the DS and could very well be moving back to block chain valuations. Gold has had a bit of a collective breakout for a decade or so now as BRIC, or white hat, nations have gathered to gain price control. Silver, however, has not. If Silver is truly the money of the common man, it is my belief that once these assets are 'block chained' away from fiat and into a proper finite value we will see valuations increase significantly... with Silver seeing the biggest increase and Platinum and Palladium close behind. Carry on my good Anon... ~M